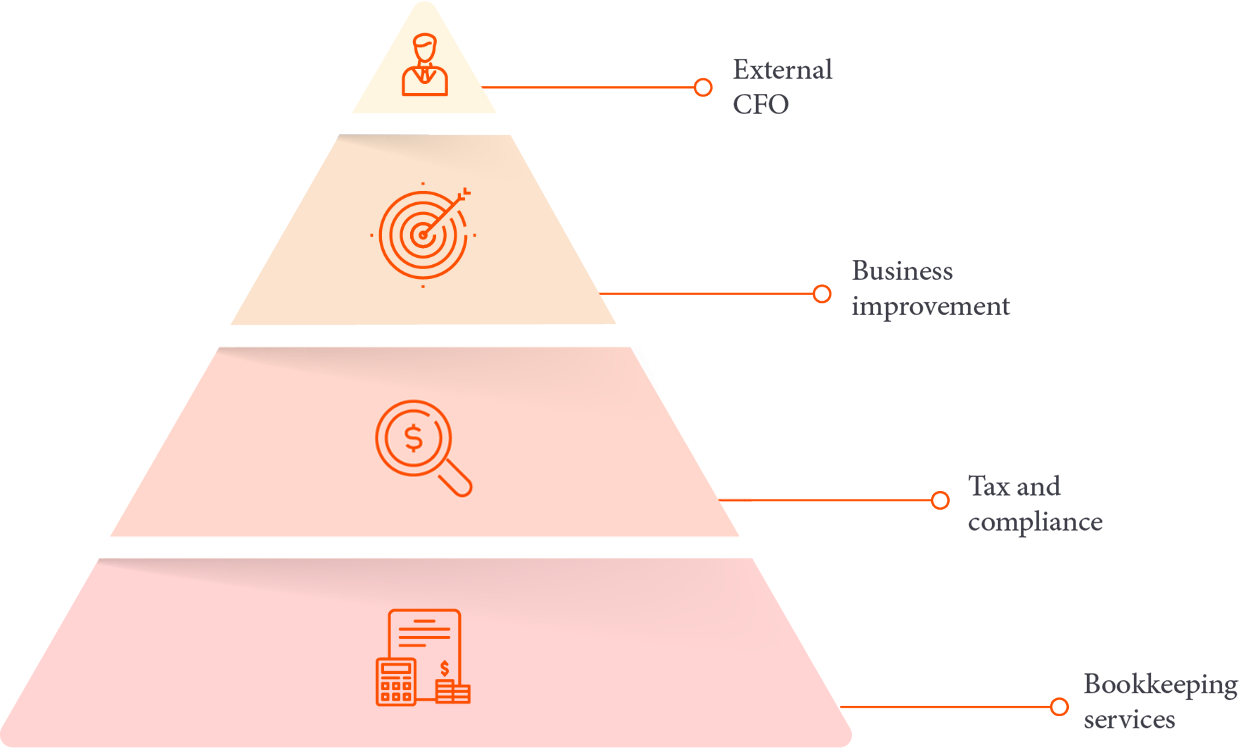

Adding value, every step of the way

Our expert services are designed to build success at

every stage of your financial journey. From

bookkeeping, compliance and tax to advising you in

all aspects of your business and acting as an external

CFO, we specialise in providing long-term, reliable

support that helps you achieve your financial goals.

Resources

Who we are

At McAdam Siemon Business Advisors, we take a uniquely

long-term approach to our client relationships. Our

network of industry-leading experts specialise in areas

including management rights, self-managed super funds,

SMEs, bookkeeping, compliance and tax services –

meaning you can take care of all your business and

financial needs in one place.

Our network

Whatever you need, our trusted network of experts is ready to provide meticulous and trustworthy

services and support across a broad range of financial sectors.