I trust my Accountant: why can’t they advise me about an SMSF?

Written for McAdam Siemon Pty Ltd, by Eric Walters FCPA(FPS) FAICD

The short answer is – they can, BUT….

Over the past several years, particularly following the Global Financial Crisis (also popularly referred to as: the GFC, the Great Recession, the global credit crunch), the rules and regulations around the provision of advice in relation to financial products have been tightened somewhat: and the regulations dealing with the necessary qualifications and experience of those delivering such advice have resulted in changes in licensing for Accountants as well as increased regulation for financial planners generally.

Whilst the previous provisions (the ‘Accountants’ exemption’) were more often recognised in the breach (‘ignored’) than complied with, the new rules which come into full effect on 1 July 2016 are far more onerous on accountants. Hence it is likely that there will be some reluctance on the part of most accountants to provide even the most basic of advice about whether to start, or indeed to continue, a self-managed superannuation fund (an SMSF) – once they understand how these new rules apply.

Under the Accountants’ exemption, accountants could advise about forming an SMSF – but could not advise about rolling existing superannuation accounts into that SMSF; nor about how to invest the contributions received by the SMSF.

In a change that took effect on 1 July 2014, this exemption is being phased out in favour of a limited licensing regime: accountants who extend their already broad range of expertise to qualify for the granting of the limited licence will need to undertake additional study – and maintain their new skills and knowledge with ongoing professional education.

Under the limited licence, accountants will be able to (amongst a limited range of compliance and associated ‘administrative’ matters) –

- Advise on the establishment of an SMSF;

- Advise on the formulation of an Investment Strategy;

- Provide general information about investment assets – but NOT any specific shares, property of managed fund products; and

- Provide general information about the various types of personal life insurance – but NOT about any particular insurance company’s product offering.

….and so, in view of the onerous conditions applicable to attaining the limited licence; and the justifiable approach of ASIC in supervising this rapidly expanding area of their responsibility – it is not surprising that many accountancy practices elect to outsource their SMSF advisory tasks to comprehensively-licensed financial planners.

Our position

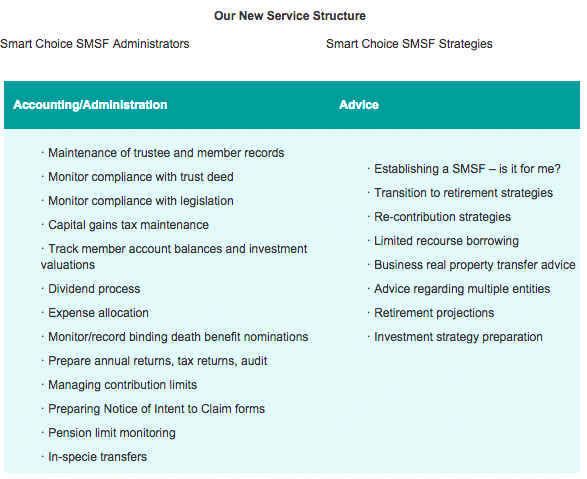

McAdam Siemon Pty Ltd has operated under the Accountants’ exemption in the past, but since the incorporation of SmartChoice SMSF Administrators Pty Ltd (‘SmartChoice’, as an associated entity of the accountancy practice), refers all requests for advice in relation to SMSFs and their administration to that company.

One of the partners, John Siemon, is a director of SmartChoice: he is qualified and holds a limited advice licence. John will be supported by Susan Stainwald (who works in SmartChoice) who is currently undertaking the requisite licensing process. Under this arrangement, investment advice is often referred to financial planning specialists as appropriate to the circumstances of each SMSF.

ASIC: the Regulator for Financial Advice participants

Whilst the administration compliance of SMSFs is monitored by the ATO, financial planning advice generally is regulated by ASIC. As SMSFs are considered a financial product, advisers dealing with such an entity – whether accountants holding a limited advice license, or comprehensively-licensed financial planners, must be mindful of ASIC’s requirements in administering the legislation and regulations prescribed by the Federal Parliament.

In a couple of recent information papers (INFO 205 and INFO 206), ASIC has provided detail as to what they will be checking on in relation to advice that is provided to trustees of SMSFs, regardless of the license status of the person providing the advice: respectively they deal with the disclosure of ‘risks’ and ‘costs’ to trustees and the members of SMSFs.

Summaries of the above-referenced Information Sheets are attached below: for full details – and for related reading on the ASIC website, refer to the following links: INFO205 and INFO206.

All of the matters covered by these Information Sheets from ASIC are able to be dealt with by a comprehensively – licenced financial planner and/ or by an Accountant holding a limited financial planning licence: the Accountants’ exemption will not allow the provision of such advice by an unlicensed Accountant.

Review of your SMSF decision

If you have been considering either –

- moving your superannuation accumulations into a self-managed environment, or

- wanting to review the wisdom of continuing with your SMSF,

John Siemon, is a director of SmartChoice: he is qualified and holds a limited advice licence. John is supported by Susan Stainwald, who is currently undertaking the requisite licensing process. Under this arrangement, investment advice is often referred to financial planning specialists as appropriate to the circumstances of each SMSF.

Call our office on 1300 366 316 to make an appointment to meet with John to gather the information necessary to formulate advice on the matter:

Eric is a Director and Financial Planner at Continuum Financial Planners Pty Ltd: their website has articles on superannuation matters and SMSF particularly – click the link to access these.

DISCLAIMER: The information contained in this article is general in nature and does not take into account personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it and any relevant product having regard to your objectives, financial situation and needs. In particular, you should seek appropriate financial advice and read relevant Product Disclosure Statements or other offer documents prior to acquiring any financial product.